Professional liability insurance protects businesses when employees make mistakes in the professional services they’ve provided to customers or clients. This coverage is also known as errors and omissions insurance (E&O). Even if you’re an expert in your business, mistakes happen. And if your client or customer thinks a mistake in your professional services caused a financial loss, they can sue you.

If your business offers professional services and you don't have professional liability coverage, you can be held liable if a customer believes you made a mistake. Even if it didn’t cause them financial loss, you can still get sued. Small business owners should consider having professional liability coverage because it protects businesses when they need it most. You should especially consider having this coverage if you:

If the professional services that you or your company provided result in damage or injury to a client. For example, your accounting firm makes a clerical error that costs your client thousands of dollars.

If a client claims that false or misleading information convinced them into a contract agreement with you or your company, which lead to damages to the client. For example, your real estate firm recently sold a townhouse to a couple that was planning on starting a daycare. However, when the couple moved in, the townhouse association informed them they couldn’t use the property for a business. The new owners decide to sue you for negligence.

If a customer claims that you provided advice that caused them damage. For example, a client sues your florist shop for errors in the services you provided after you failed to deliver flowers on time for their wedding.

If someone accuses you or your business of libel or slander, whether it’s true or not. For example, a competitor claims that your new advertisements are slandering their business and sue you for damages.

If someone claims you or your business used their copyrighted work without their permission and they sue you for copyright infringement. For example, a sound engineer sues your company for using one of their sounds without their permission in one of your new advertisements.

Professional liability insurance can help cover your defense costs if a client sues you for mistakes in the professional services you provided them. Defense costs include attorney fees and other court-related expenses.

Even if you didn’t do anything wrong and believe you’ve made no mistakes, your client can still sue your business. Without coverage, you’ll have to pay expensive legal defense costs out of pocket.

Professional liability insurance is an important coverage that business owners who provide a service to a client or customer should have. You’ll want to get professional liability insurance coverage if you:

Be aware that some states require this type of business insurance. Learn more about who needs professional liability insurance today.

We offer professional liability insurance for a number of different industries, including the following:

Your cost is unique to your business. What you pay for professional liability insurance will vary by product, limits chosen and risk class or hazard group of your business.

| Product | Avg. Minimum Monthly Premium*** 1 |

|---|---|

| Misc. Professional Liability Standalone Coverage | $76 |

| Misc. Professional Liability Endorsements | $50 |

| Architects and Engineers Professional Liability | $279 |

| Healthcare Professionals Professional Liability | $132 |

| Errors & Omissions Insurance for Technology Companies | $164 |

*** Quotes will vary by business depending on the size of your business, the state your business is located in, coverage limits chosen, and the risk class your business is associated with.

Factors that can impact your professional liability insurance cost include:You can work with our specialists to get the right amount of errors and omissions (E&O) insurance coverage for your business. Backed by more than 200 years of experience, we can help protect you with professional liability insurance for small business.

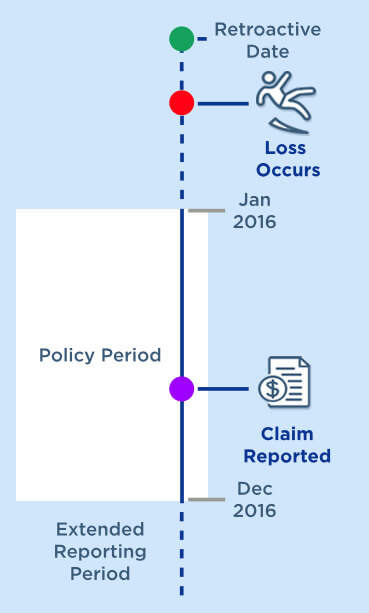

Many insurance companies write a professional liability insurance policy on a claims-made basis with a retroactive date and extended reporting period.

The retroactive date means you’re covered for incidents that happen on or after a specified date in your policy.

The extended reporting period helps cover claims filed within a certain time after your policy expires. This is generally a 30- to 60-day period, but you can extend this period to a year or more for an additional cost.

Your insurance company only covers claims against your business during your policy period within the extended reporting period. And the claim must be from a covered error or omission that happened after your policy’s retroactive date. It can help cover:

Some policies can also be written on an occurrence policy. This means there will be coverage for losses that happen during your policy period, even if the claim gets reported after your policy expires.

Since the claim was reported during the policy period and the loss occurred after the retroactive date, it would be eligible for coverage under a claims-made policy.

If a claim is brought after the policy’s expiration, it can get coverage if it’s reported within the extended reporting period.

The main difference between general liability and professional liability is in the types of risks they cover. General liability insurance covers physical risks, such as bodily injuries and property damage. Professional liability insurance covers more abstract risks, such as errors and omissions in the services your business provides. To make sure your business is fully protected, it’s a good idea to carry both types of insurance.

Yes, professional liability insurance coverage can help protect your business even if the claim against your business is determined to be baseless.

Professional liability insurance provides coverage for claims of negligence in a lawsuit against you. Even if you didn’t do anything wrong and believe you’ve made no mistakes, a client can still sue your business.

Yes, errors and omissions insurance is the same type of coverage as professional liability insurance. E&O insurance helps protect you and your company if a third party claims that you or your business made a mistake in the professional services provided. Just like professional liability insurance, E&O insurance coverage can help cover the costs if a customer files a claim against your small business.

When you’re ready to get a professional liability insurance quote, it’s a good idea to have important business documents on hand, such as:

Every small business owner aims to run their business perfectly, but we know that mistakes can happen when we least expect it. If a mistake does happen and it harms your client, they can sue your business.

For example, if one of your analysts at your accounting firm gives a client advice based on outdated data and it results in the client losing thousands of dollars. Your client could then sue your business for negligent misrepresentation because of your employee’s mistake. With professional liability insurance, you’ll be protected from the costly claims resulting from this lawsuit including settlements and legal fees.

A certificate of liability insurance (COI) is a form that provides proof of professional liability insurance coverage for your business. This form summarizes the benefits and limits of your liability insurance policy. You’ll get a certificate of insurance (COI) automatically as proof of insurance when you get your policy. If a company requires another copy of your certificate, you have two different ways to obtain one:

Professional liability insurance doesn’t cover all types of liability claims, like bodily injuries. For example, let's say someone sues your business after a slip and fall in your store. Your professional liability insurance coverage won't help. Instead, you'll need general liability insurance coverage to cover bodily injuries and property damage claims.

When you add an additional insured on a professional liability policy, you’re extending your insurance coverage to another person or company. Be aware that the additional insured can file a claim with your insurer if a client sues them.

Get more answers to professional liability insurance frequently asked questions.

“I was very pleased with the responsiveness and professionalism of The Hartford throughout this process. … I was also impressed with the counsel they provided me with. He definitely knew his stuff, and helped prepare me for what to expect in my first deposition.”

“I am a first-time business owner so learning how things work is very important. Ms. Faye took time to explain the benefits of Hartford and how if I needed her in the future she could be contacted. I love that she made me feel special.”

“Going through a claim experience is frustrating for busy people. Hartford and all representatives that I worked with streamlined this process to ensure I was able to focus on what matters!”

“The Hartford is very helpful and understanding when it comes to any situation, they are timely and 9/10 they will probably know what you need to do before you know yourself.”

“The team at Hartford was effective, and empathetic with our claim. They… gave us great guidance through the process. Thank you! I will definitely recommend Hartford's services to everyone.”

“First class responsiveness, claim procedures full[y] explained in plain English, claim processing was prompt and error proof.”

1 Premium amounts presented are based on monthly premium paid by The Hartford's Small Business customers between 1/1/24 and 6/1/2024 for 12-month policies. Premium is derived from a number of factors specific to yours business and may vary.

Additional disclosures below. Back To Top© 2024 The Hartford

The Hartford shall not be liable for any damages in connection with the use of any information provided on this page. Please consult with your insurance agent/broker or insurance company to determine specific coverage needs as this information is intended to be educational in nature.

The information contained on this page should not be construed as specific legal, HR, financial, or insurance advice and is not a guarantee of coverage. In the event of a loss or claim, coverage determinations will be subject to the policy language, and any potential claim payment will be determined following a claim investigation.

Certain coverages vary by state and may not be available to all businesses. All Hartford coverages and services described on this page may be offered by one or more of the property and casualty insurance company subsidiaries of The Hartford Financial Services Group, Inc. listed in the Legal Notice.

The Hartford Financial Services Group, Inc., (NYSE: HIG) operates through its subsidiaries under the brand name, The Hartford, and is headquartered in Hartford, CT. For additional details, please read The Hartford’s Legal Notice.

* Customer reviews are collected and tabulated by The Hartford and not representative of all customers.