Familiarizing yourself with AICPA question types in each CPA Exam section can help you build a successful preparation strategy. Try a few of our sample questions from each exam section now and see the difference for yourself.

The Auditing and Attestation (AUD) exam includes 72 multiple-choice questions (MCQs) and 8 task-based simulations (TBSs). Each question type makes up 50% of your score on this section. See if you can answer these free AUD CPA Exam sample questions.

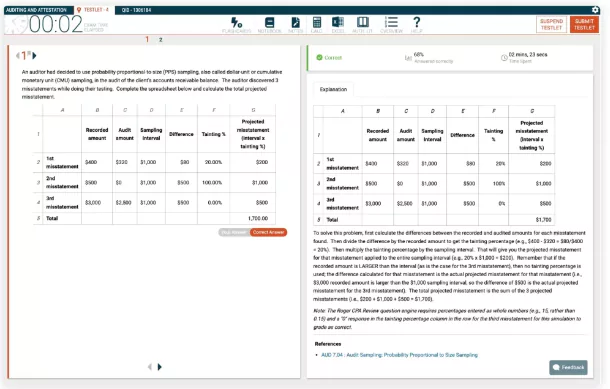

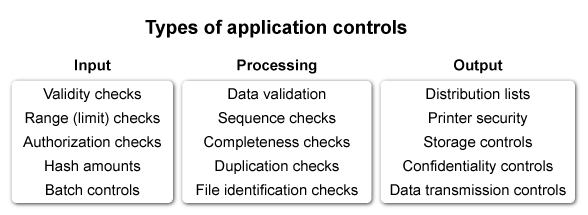

Which of the following is an input control designed to ensure the reliability and accuracy of data?

| Limit Test | Validity Check Test | |

| A. | Yes | Yes |

| B. | Yes | No |

| C. | No | Yes |

| D. | No | No |

Input controls are designed to provide reasonable assurance that data received have been properly authorized and accurately entered or converted for processing. These controls also provide the opportunity for entity personnel to correct and resubmit data that were initially rejected for being erroneous.

A limit test is designed to assure that all input falls within an appropriate range. If the input falls outside of the range (eg, a birth date before 1900), it is rejected. A validity check is designed to match data input to a predetermined list of valid data. If the input doesn’t match the list (eg, “USA” entered as a state code), it is rejected. Both of these controls are intended to ensure the reliability and accuracy of data input (Choices B, C, and D).

Things to remember:

Limit tests and validity checks are input controls, which are designed to provide reasonable assurance that input is accurate before being processed. Limit tests ensure input is within an appropriate range, while validity checks match data input to a predetermined list of valid data.

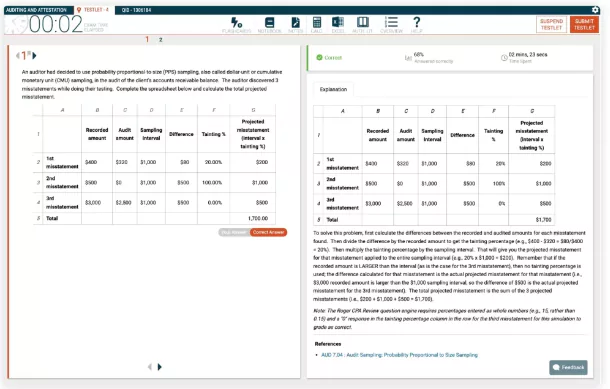

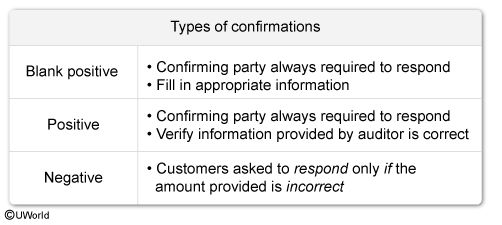

An auditor decides to use the blank form of accounts receivable confirmation. The auditor should be aware that the blank form may be less efficient because

| A. It does not provide positive third-party confirmation of account balances. |

| B. It is more likely to require a reconciliation of responses with client information. |

| C. It is not as reliable as other forms of account confirmations. |

| D. It is more difficult to prepare. |

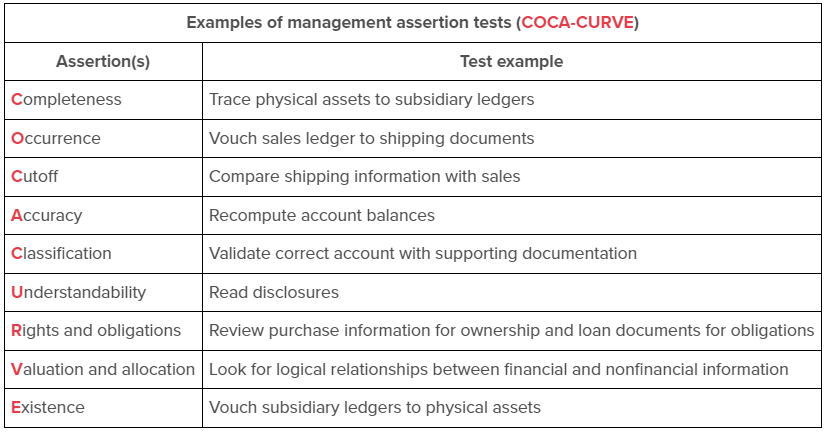

External confirmations are one of the more reliable sources of audit evidence because they are obtained directly from parties outside the entity and exist in documentary form, which is more reliable than oral evidence. A/R confirmations can provide audit evidence associated with the existence , rights and obligations , allocations and valuations , and completeness assertions .

Confirmations can be negative , positive , or blank . Blank confirmations are a type of positive confirmation where the customer is asked to record the amount they owe to the client (Choice A). Positive confirmation is more reliable than negative because the customer indicates either agreement or disagreement with the client’s recorded A/R balance (Choice C). Because blank confirmations show only customer names and addresses without the A/R balances, they are easier to prepare (Choice D).

Negative and positive confirmations ask the customer to confirm or indicate any differences in the A/R balance recorded by the client. Blank confirmations do not contain any indication from the client of the customer’s A/R balance, so they may be less efficient and more difficult for the auditor to reconcile customer responses with client information. For example, returned items in transit may be included in the customer’s version of their amount due but not yet received by the client and reflected in the A/R balance.

Things to remember:

Because blank confirmations do not contain any indication from the client of the customer’s A/R balance, they may be less efficient and more difficult for the auditor to reconcile customer responses with client information.

An auditor’s objective in the performance of audit procedures is to obtain evidence that either supports or refutes management assertions. Which of the following is an action designed to achieve this objective?

| A. Comparing financial and nonfinancial data. |

| B. Developing and maintaining a system of quality control. |

| C. Preparing adequate and appropriate documentation. |

| D. Increasing the desired level of detection risk. |

During an audit, client management asserts that the financial statements are complete, clear, correct, and in compliance with GAAP or an acceptable financial reporting framework. The auditor then gathers evidence to either support or refute these assertions.

The auditor may compare financial (eg, equipment depreciation expense) and nonfinancial (eg, vendor information about equipment’s expected useful life) information. This comparison can provide evidence regarding the validity of the valuation assertion (eg, depreciation expense is based on reasonable estimates).

(Choices B and C) The audit firm must develop a system of quality control, and the auditors must create adequate, appropriate documentation to provide evidence that the audit complies with professional standards. These activities do not provide evidence that supports or refutes management assertions regarding the financial statements.

(Choice D) The desired or acceptable level of detection risk might decrease when there is greater risk of material misstatement . This action would occur after the auditor obtains evidence that refutes management’s assertions.

Things to remember:

A comparison of financial (eg, equipment depreciation expense) and nonfinancial (eg, vendor information about equipment useful lives) information can provide audit evidence that either supports or refutes management assertions regarding financial statements.

An auditor uses the assessed level of control risk to

| A. Evaluate the effectiveness of an entity’s internal control policies and procedures. |

| B. Identify transactions and account balances in which inherent risk is at the maximum. |

| C. Indicate whether materiality thresholds for planning and evaluation purposes are sufficiently high. |

| D. Determine the acceptable level of detection risk. |

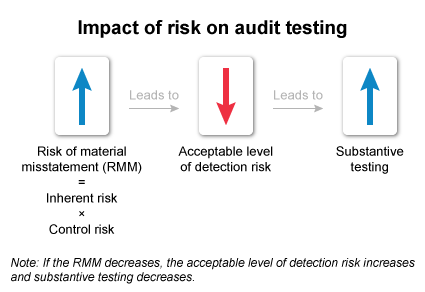

Control risk (CR) is the risk that internal control will fail to prevent a material misstatement. Along with inherent risk , CR determines the risk that a material misstatement exists in the financial statements. The higher the risk of material misstatement (RMM) , the less risk auditors are willing to take that the audit will fail to identify a material misstatement (ie, detection risk ). Detection risk can be lowered by the application of additional substantive procedures .

(Choice A) An auditor evaluates the effectiveness of an entity’s internal control to assess CR, not the other way around.

(Choice B) Inherent risk is the RMM due to factors other than internal control (eg, complexity of transactions). It does not affect, and is not affected by, the assessed level of CR.

(Choice C) If RMM is high, the auditor may design procedures to detect smaller individual misstatements (ie, lower tolerable misstatement ), thereby reducing the risk that the combined effect of individual misstatements is material. Materiality thresholds are based on the type or amount of misstatement that might influence the decisions made by users of the financial statements. Materiality is not affected by RMM.

Things to remember:

The risk of material misstatement (RMM) is a function of control risk and inherent risk. As RMM increases, the acceptable level of detection risk is decreased. As RMM decreases, the acceptable level of detection risk is increased.

Take a look at a typical sample question from another provider below. The question shows you what you’ll see on the exam, but that’s not enough to help you pass. Their limited explanations address the right answer choice but do not go the extra mile to explain the wrong choices – so you don’t make the same mistakes on exam day.

The controller of a small utility company has interviewed audit firms proposing to perform the annual audit of their employee benefit plan. According to the guidelines of the Department of Labor (DOL), the selected auditor must be

| A. The firm that proposes the lowest fee for the work required. |

| B. Independent for purposes of examining financial information required to be filed annually with the DOL. |

| C. Included on the list of firms approved by the DOL. |

| D. Independent of the utility company and NOT relying on its services. |

Explanation (If Available):

DOL guidelines do require independence for such work. Although DOL independence rules differ from AICPA rules, independence is still required.

The Financial Accounting and Reporting (FAR) exam consists of 66 multiple-choice questions (MCQs) and 8 task-based simulations (TBSs). Each question type represents 50% of your score on this section. Try the below free FAR CPA Exam sample questions now.

Which of the following is the annual report that is filed with the United States Securities and Exchange Commission?

| A. Form 8-K. | |

| B. Form 10-K. | |

| C. Form S-1. | |

| D. Form 10-Q. |

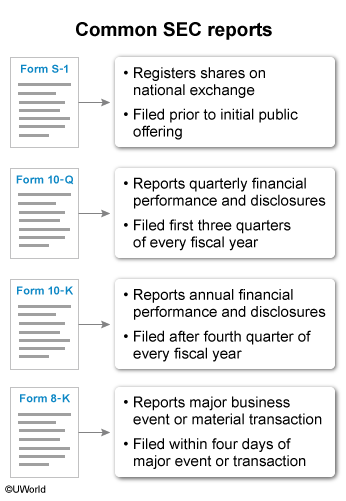

Publicly traded companies must file reports with the SEC so investors and the public receive material information in a timely manner. Users of this information must make vital decisions about providing resources (eg, investing or providing credit) to the company.

Form 10-K is filed annually after the fourth quarter of the fiscal year and has several requirements, including audited financial statements, management analysis, market risk disclosures, and internal controls information.

(Choice A) Form 8-K must be filed within four days of a major business event. These events may include merger and acquisition activity; securities sales; bankruptcy; and a change in directors, principal officers, or auditing firms.

(Choice C) Form S-1 is a registration form required as part of the initial public offering process and must be filed before shares can be listed on a national exchange.

(Choice D) Form 10-Q is similar to Form 10-K except that it is filed quarterly for the first three quarters of the fiscal year. In addition, Form 10-Q is more limited in scope and is less comprehensive than Form 10-K.

Things to remember:

Publicly traded companies must file reports with the SEC so investors and the public receive important information in a timely manner. Form 10-K is filed annually and has several requirements, including financial statements, management analysis, market risk disclosures, and internal controls information.

What is the purpose of reporting comprehensive income?

| A. To summarize all changes in equity from nonowner sources. | |

| B. To reconcile the difference between net income and cash flows provided from operating activities. | |

| C. To provide a consolidation of the income of the firm’s segments. | |

| D. To provide information for each segment of the business. |

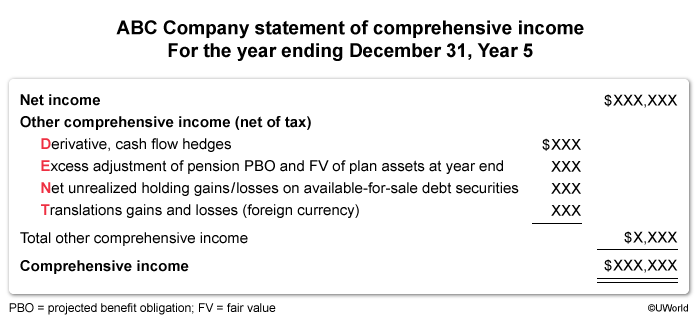

An entity’s comprehensive income is the total of its net income (loss) and other comprehensive income (OCI) . Net income (loss) is closed annually to an entity’s retained earnings . However, because OCI reports the unrealized portion of certain transactions that may or may not be realized in the future, it is transferred to accumulated OCI , a separate component of stockholders’ equity.

The purpose of comprehensive income is to report all changes in equity from nonowner sources. Therefore, by including OCI, comprehensive income provides a more complete accounting of all changes from nonowner sources.

(Choice B) Reconciling the difference between net income and cash flows provided from operating activities will show transactions reported using the accrual basis versus the cash basis of accounting.

(Choices C and D) All entities, including those with business segments, are required to report comprehensive income. Information regarding business segments is provided in the notes to the financial statements.

Things to remember:

An entity’s comprehensive income is the total of its net income (loss) and other comprehensive income (the unrealized portion of certain transactions). The purpose of comprehensive income is to report all changes in equity from nonowner sources.

Wall Corp. offers an employee stock purchase plan through which employees can elect to have money withheld from their paychecks to purchase Wall stock. Wall’s plan specifies the following:

| For every $1 contributed from employees’ wages for the purchase of Wall’s common stock, Wall contributes $2. |

| The stock is purchased from Wall’s treasury stock at market price on the date of purchase. |

The following information pertains to the plan’s Year 1 transactions:

| Employee contributions for the year | $ 350,000 |

| Market value of 150,000 shares issued | 1,050,000 |

| Carrying amount of 150,000 shares of treasury stock issued (cost) | 900,000 |

Before payroll taxes, what amount should Wall recognize as expense in Year 1 for the stock purchase plan?

| A. $150,000 | |

| B. $700,000 | |

| C. $900,000 | |

| D. $1,050,000 |

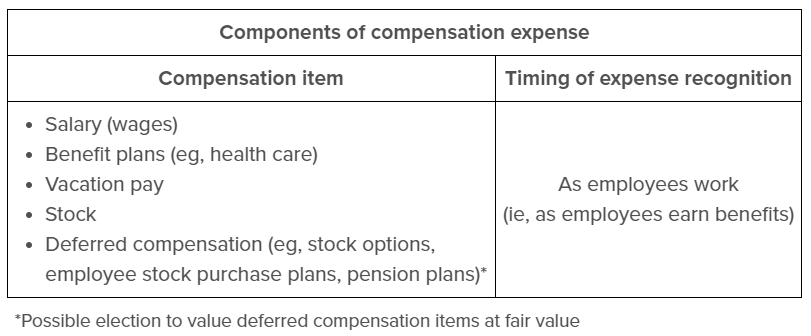

GAAP requires that expenses (or losses) be recognized as they are incurred or when the loss of a future benefit is discovered. Costs associated with employee compensation are recorded as employees work (eg, salary expense) or earn benefits (eg, vesting pension benefits ).

The market price of the stock issued under the employee stock purchase plan (ESPP) is $1,050,000. However, $350,000 of this cost was contributed by the employees, and is therefore not an expense for Wall Corp. Only the amount contributed by Wall is an expense for the company (Choice D).

Wall must contribute $2 to the ESPP for each $1 contributed by employees. Therefore, Wall’s cost is incurred as employees contribute. Since employee contributions were $350,000 for Year 1, Wall’s expense recorded is $700,000 ($350,000 × $2).

(Choice A) Expense of $150,000 is the difference between the market price of the 150,000 shares of stock issued under the ESPP and the cost of the treasury stock . This amount is not recorded as an expense, but is instead booked to additional paid-in capital when the stock is reissued.

(Choice C) The cost of the 150,000 treasury shares issued is $900,000; however, this amount is not recorded as an expense. Instead, the expense recorded is based on Wall’s financial contribution to the ESPP.

Things to remember:

Expenses (or losses) are recognized when incurred or when the loss of a future benefit is discovered. Costs associated with employee compensation (including benefits such as stock purchase plans) are recorded as employees work/earn benefits.

The following financial ratios and calculations were based on information from Kohl Co.’s financial statements for the current year:

| Accounts receivable turnover |

| Ten times during the year |

| Total assets turnover |

| Two times during the year |

| Average receivables during the year |

| $200,000 |

Kohl made all sales on credit. What was Kohl’s average total assets for the year?

| A. $2,000,000 |

| B. $1,000,000 |

| C. $400,000 |

| D. $200,000 |

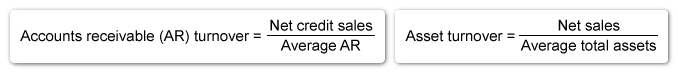

A variety of activity ratios can be used to evaluate the performance of a company. For example, the asset turnover ratio measures how efficiently an entity’s assets are used to generate sales (net sales divided by average total assets). Meanwhile, the accounts receivable (AR) turnover ratio measures how efficiently a company collects debts from credit sales to customers (net credit sales divided by average AR). If an entity has only credit sales, the numerator will be the same in both ratios.

In this scenario, both ratios, combined with the information Kohl provided, can be used to solve for the average total assets for the year. Because all of Kohl’s sales were on credit, the numerator in the AR turnover and asset turnover ratios will be the same. Kohl will report average total assets of $1,000,000, calculated as follows:

| AR turnover = 10 1 | Asset turnover = 2 1 | Average AR = $200,000 |

| Use average AR and AR turnover ratio to solve for net credit sales: | ||

| AR turnover = Net credit sales Average AR | 10 = Net credit sales $200,000 | Net credit sales = $2,000,000 |

| Use net credit sales and asset turnover ratio to solve for average total assets: | ||

| Asset turnover = Net sales Average total assets | 2 = $2,000,000 Average total assets | Average total assets = $1,000,000 |

(Choice A) Kohl’s total sales for the year are $2,000,000.

(Choice C) Average assets of $400,000 is incorrectly calculated by multiplying the asset turnover ratio (2:1) by the average receivables ($200,000).

(Choice D) Kohl’s average AR for the year are $200,000.

Things to remember:

The accounts receivable (AR) turnover ratio measures how efficiently a company collects debts from credit sales to customers (net credit sales divided by average AR). The asset turnover ratio measures how efficiently an entity’s assets are used to generate sales (net sales divided by average total assets). If an entity has only credit sales, the numerator will be the same in both ratios.

Take a look at a typical sample question from another provider below. The question shows you what you’ll see on the exam, but that’s not enough to help you pass. Their limited explanations address the right answer choice but do not go the extra mile to explain the wrong choices – so you don’t make the same mistakes on exam day.

Which one of the following would constitute a highly inflationary economy when determining the functional currency of a foreign entity?

| A. 20% inflation for each of the past 5 years | |

| B. 30% inflation for each of the past 3 years | |

| C. 35% inflation for each of the past 3 years | |

| D. 20%, 35%, and 40% inflation, respectively, for each of the past 3 years |

Explanation (If Available):

For determining a functional currency, a highly inflationary (hyperinflationary) economy is one that has experienced a cumulative inflation of 100% or more over the past 3 years. Inflation of 35% per year over the past three years is a cumulative 105% and constitutes a highly inflationary economy.

The Regulation (REG) exam consists of 76 multiple-choice questions (MCQs) and 8 task-based simulations (TBSs)–each question type is weighted at 50% of your score on this exam section. See if you can answer these free REG CPA Exam sample questions.

Prior to the bankruptcy filing, but while insolvent, Rusk engaged in the following transactions:

Below is relate to Rusk’s creditors and the February 1 and May 1 transactions. For each item, determine whether only statement I is correct, whether only statement II is correct, whether both statements I and II are correct, or whether neither statement I nor II is correct.

(Row 1) As a secured creditor, Safe will be entitled to the collateral before any distributions are made to other creditors. Safe will receive the entire amount of the mortgage due if the proceeds from the sale of the warehouse are sufficient, in which case any remaining proceeds would be available for distribution to other creditors. If the proceeds from the sale of the warehouse are not sufficient to pay the entire mortgage, Safe will receive all of the proceeds and will be an unsecured creditor as to the remaining balance of the mortgage.

(Row 2) Employee claims will not necessarily be paid in full after payment of secured creditors. After the payment of secured parties, administrative expenses will be paid, followed by post petition or involuntary gap creditors. Employee claims, up to $13,650 per employee, will be paid next. These and other priority claims will be paid before payment of any claims of general creditors.

(Row 3) The claim for 20X4 income taxes is a priority claim, but it is not considered a secured claim. After payment of secured parties, administrative expenses will be paid, followed by post petition or involuntary gap creditors. Employee claims, up to $13,650 per employee, will be paid next, followed by advances to customers. Claims for taxes will be paid next, prior to payment for claims of general creditors.

(Row 4) Directors are considered insiders. As a result, the payments to the directors on February 1 are considered preferential transfers since they were within one year of the petition.

(Row 5) The purchase on May 1 was made in the ordinary course of business and Rusk received new value for the payment. As a result, it is not a preferential transfer.

Which of the following actions would most likely be an infringement of the exclusive rights of the owner of a copyrighted work?

| A. Preparing a foreign language translation of the copyrighted work. | |

| B. Writing a book review of the copyrighted work that includes excerpts from the work. | |

| C. Making multiple copies of extracts from the copyrighted work for classroom use. | |

| D. Using the copyrighted work for research. |